am i taxed on stock dividends

Then the Tax Cuts and Jobs Act TCJA came along and changed things up effective January 2018. Your tax bracket alone is going to influence your qualified dividends tax rate.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

ABC Pty Ltd decides to retain 50 of the profits within the business and to pay shareholders the remaining 175 as a fully franked dividend.

. In 2018 that puts you in the 24 tax bracket which means that 9000 becomes 6840 after taxes. Ordinary dividends are taxed as ordinary income. If youre in the 10 to 15 percent bracket then youre not going to be taxed anything on qualified dividends.

Lastly investors that were in the four middle brackets 25 28 33 or 35 paid a 15 tax rate for their income derived from qualified dividends. The 0 tax rate applies to all of the income in the 10 and 12 brackets. The qualified dividend tax rate increases to 15 for taxable income above.

If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent. The rate depended on the taxpayers ordinary income tax bracket. The benefit of retirement accounts is that your money grows tax-free until retirement.

Specifically you must record 488851 or more in taxable income as of the 2019 tax requirements. The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. Am i taxed on stock dividends.

Dividends from foreign corporations 5. 40001 for those filing single or married filing separately 54101 for head of household filers or. For stock dividends it depends on the type of account.

Am I Taxed On Stock Dividends Double taxation of dividends differential taxation of stockholders and income tax relief taxation of corporate earnings to discuss the personal income tax on dividends and neglect the fact that the corporate earnings out of which dividends are paid have been taxed at the corporate level as in the first part of chapter 3 does. By the end youre going to lose 365 of your dividend income to taxes. This information is included on the individuals Form 1040.

The 15 tax rate applies to just about all of the income covered in the 22 24 32 and 35 tax brackets. 1 hour agoRussian President Vladimir Putin. Gazprom would pay an extra 125 billion rubles roughly 22 billion.

1 Generally in a nonretirement brokerage account any income is. Qualified dividends are dividends that meet the requirements to be taxed as capital gains. Dividend Tax Rates for the 2022 Tax Year.

The dividends cant be non-qualified certain criteria must be met for this and. The rates are set at 0 15 and 20 just as they have always been. Dividends are reported to individuals and the IRS on Form 1099-DIV.

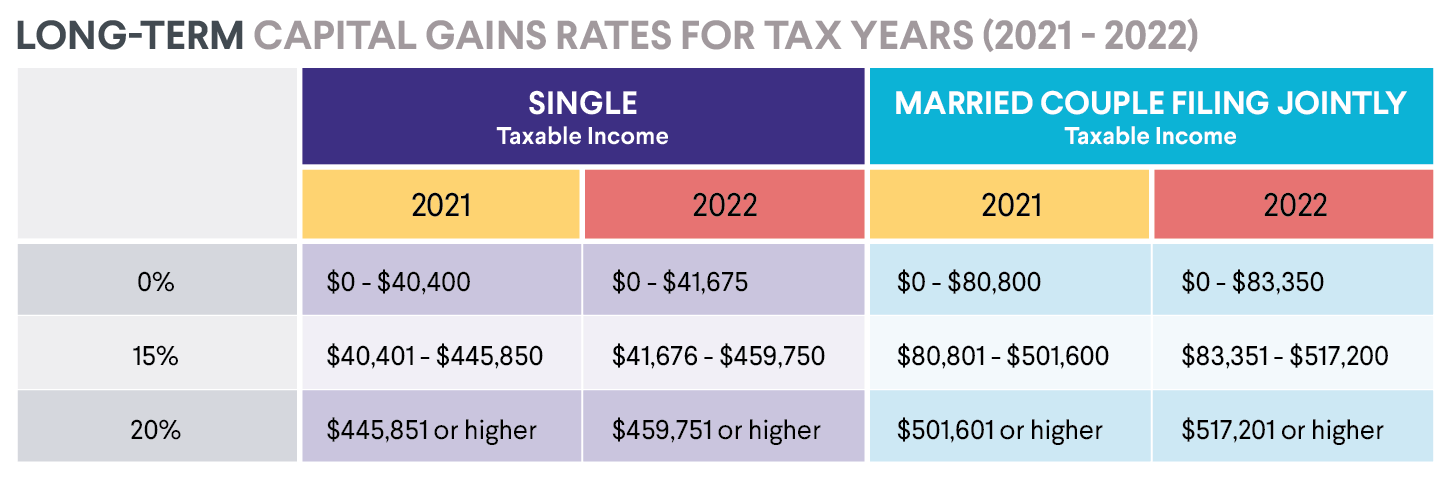

The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. So lets look at the 2021 tax brackets for single and joint filers of qualified dividends.

The next table presents the tax rates assessed on ordinary or non-qualified dividends in 2022 depending on your taxable income and filing status. For single filers you pay a 0 capital gains rate for up to 40400. The next step down at a 15 rate is anyone who records 78751 to 488850 in taxable income.

The former is taxed at the capital gains rate. It must pay 30 tax on that profit which is 150 per share leaving 350 per share able to be either retained by the business or paid out as dividends to shareholders. Qualified dividends are taxed at a lower rate than ordinary income at the capital gains tax rate.

Pin on Investing. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. To see why you should have a stocks and shares isa check out trading 212 invest vs isa.

Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. If shares are held in a retirement account stock dividends and stock splits are not taxed as they are earned. Qualified Dividend Tax Benefits.

However as the 401 k example shows these dividend-yielding stocks are susceptible to similar fees and taxation. In both cases people in. According to the current tax rates if your total taxable income is below 40000 you dont have to pay any tax on qualified dividends.

Preferred stock dividends can generate tremendous growth in a tax-sheltered account especially if they are reinvested regularly. Under current law qualified dividends are taxed at a 20 15 or 0 rate. The tax rate on nonqualified dividends.

80801 for married filing jointly or qualifying widow er filing status. Since they are taxed as ordinary income ordinary dividends are taxed at your marginal tax rate. You still need to pay taxes either before or after you contribute the money but you will not have to pay.

Ordinary non-qualified dividends. Russian lawmakers are poised to approve a temporary windfall tax on its state-run gas giant. In the case of the cd the 3000 is taxed as ordinary income.

Qualified dividends were taxed at rates of 0 15 or 20 through the tax year 2017. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. And heres something nice.

This is usually lower than the rate for nonqualified dividends. Qualified dividends are taxed differently than normal dividends.

Capital Gains Tax What Is It When Do You Pay It

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Tax Advantages For Donor Advised Funds Nptrust

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Tax Implications Of A Dividend H R Block

What You Need To Know About Capital Gains Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Taxation Of Dividend Income And Capital Gains

How To Pay No Tax On Your Dividend Income Retire By 40

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Finances Money

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/shutterstock_342649796-5bfc3d8846e0fb00511e30c8.jpg)